Presentation Scheduled for Monday, 2:30-3:30 pm

Anticipated CE: 1 CFP, 1 MN insurance, 1 WI insurance, 1 NASBA/CPE, 1 CIMA, 1 CLE Stnd

Don’t Play in The Street - Active Management: Sometimes you don’t get what you pay for…

Competition from passive funds has led many active funds to cut fees. Martijn Cremers, a finance professor at the University of Notre Dame, believes that the price cuts have masked a disturbing trend. “When fund expenses have fallen, active managers have increasingly built portfolios that mirror their benchmarks–a phenomenon known as closet indexing.” In other words, expenses are lower but many managers are not trying as hard. So how do you ensure you are actually getting the active management that you are paying for?

Active managers by definition deviate from their respective benchmarks either by stock selection or by factor timing to add value for shareholders. Stock selection involves active bets on individual stocks while factor timing involves time-varying bets on broader factor portfolios (for example, overweighting a particular sector of the economy).

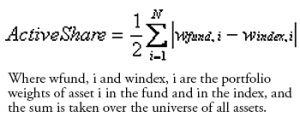

In 2009, Cremers and Petajisto published a paper titled, “How Active Is Your Fund Manager? A New Measure That Predicts Performance,” popularizing the metric of Active Share. Active Share is a measure of the differentiation of the holdings of a portfolio from the holdings of its appropriate passive benchmark index.

Sources of Active Share:

Sources of Active Share:

- Including stocks that are not in the benchmark

- Excluding stocks that are in the benchmark

- Holding benchmark stocks in different weights than the benchmark

For a mutual fund that never shorts a stock and never buys on margin, Active Share will always be between zero and 100%. In other words, the short side of the long-short portfolio never exceeds the long index position. In contrast, the Active Share of a hedge fund can significantly exceed 100% due to its leverage and net short positions in individual stocks.

Based on the Active Share calculation, Cremers and Petajisto defined four active share categories: Very Different, Moderately Different, Closet Indexer and Pure Index Fund.

| Active Share Category | Active Share % |

| Very Different from Benchmark | 80% or Greater |

| Moderately Different from Benchmark | 60%-80% |

| Closet Indexer | 20%-60% |

| Pure Index Fund | 0%-20% |

Based on Cremers and Petajisto’s sample period, 1980-2009, the Pure Index Funds grew from almost nothing in 1980 to one-fifth of mutual fund assets at the end of 2009. Closet Indexers have become even more popular, accounting for one-third of all mutual fund assets at the end of 2009.

Cremers and Petajisto discovered through their research efforts that the funds with the highest Active Share charged an average expense ratio of 1.42%. The other active fund groups exhibit slightly lower fees for lower Active Shares, but the differences were economically small for the intermediate ranges of Active Share. For example, the average expense ratio for funds with Active Share between 30% and 40% is about 1.08% per year, which is closer to the 1.23% of the group with Active Share between 60% and 70% than the 0.47% of the pure index funds. Investors are paying high expenses while investing in mutual funds that look and act similarly to an index. Clearly, investors are not getting what they believe they are paying for. Closet Indexers, who by definition stay very close to the benchmark index, can be a particularly poor choice because they almost guarantee underperformance after fees given their small allocations to active bets.

In a 2010 paper titled, “Active Share and Mutual Fund Performance,” Petajisto concludes his research by stating, “For mutual fund investors, these findings suggest that they need to pay attention to measures of active management. When selecting mutual funds, they (investors) should go with only the most active stock pickers, or combine those funds with inexpensive index funds; in other words, they should pick from the two extremes of Active Share, but not invest in any funds in the middle. The funds in the middle are providing only moderate levels of active management, which has not added enough value even to cover their fees.”

All investments are subject to risk, including the possible loss of the money you invest. Past performance does not guarantee future results. There is no guarantee that any particular asset allocation, or mix of funds, or any particular mutual fund, will meet your investment objectives or provide you with a given level of income.